20 years SRC

20 years ago, on 27 November 2000, the founding meeting of the shareholders of SRC took place. That is a long time, but in retrospect it does not seem to be the case for the acting persons. This perception is of course subjective, but a decisive factor will certainly be the rapid development in the field of information technology.

The complexity of digitalisation and the constantly growing need to create trust in new solutions is the business basis of SRC, the essential reason why SRC exists. At the same time this is also a big obligation — namely to ensure that new digital solutions are really trustworthy.

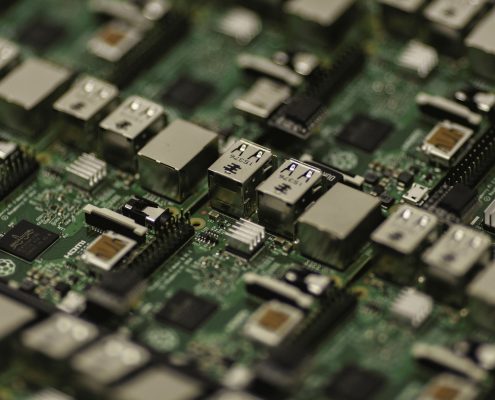

SRC’s work on such things that many people experience in their daily life can be explained vividly. These are, above all, contactless payment by card and mobile phone, secure access to bank accounts by third parties, electronic patient files, secure communication in connection with the Galileo system and in the Bundeswehr, or even quite “mundane” things such as bottle deposit machines or tamper-proof cash registers — all topics of digitisation with which millions of people come into contact in one way or another every day. The development does not end there, with Open Finance, IoT and the increased use of AI methods there are still many exciting topics to be addressed.

None of these solutions has been produced or is operated by SRC itself, but we have made a decisive contribution to all of them: We provide confidence in these digital solutions — for reliability, security and future-proofness. We create “a good feeling” in dealing with digitalisation:

— Standards for new technologies create investment security,

— Reliable functionality of new solutions through testing,

— Technical safety of new solutions through safety concepts and tests.

In fact, this “good feeling”, the trust, is something like the lubricant of digitalisation. For many people, the digitisation and mechanisation of everyday life means that processes are no longer manageable and the truth content of information is sometimes unclear. Trust makes it possible to reduce this complexity and often opens the door to acceptance of the new ways of experiencing and acting that digitisation aims to create.

The complexity of digitalisation and the constantly growing need to create trust in new solutions is the business basis of SRC, the essential reason why SRC exists. At the same time this is also a big obligation — namely to ensure that new digital solutions are really trustworthy.

In the 20 years of SRC’s existence we have carried out more than 20,000 projects. Every year there have been more and also SRC has grown year by year — not only in terms of the number of employees, but especially in terms of the expansion of expertise, partly in areas that did not exist at the time of the foundation of SRC.

The current pandemic situation does not allow us to adequately celebrate our 20th anniversary, which we would have liked to do together with our customers. We are thinking about making up for this at a suitable time. But even without a party, we would be pleased if you, our customers, continue to place your trust in us.